get paid for your opinions

EARN ROCKING REWARDS BY TAKING SURVEYS IN YOUR SPARE TIME

our rewards

what on earth is opinion outpost?

once upon a time, we had a dream...

Then we woke up and made Opinion Outpost!

At Opinion Outpost, we have created a thriving community where anyone can sign up to our online survey platform and get rewards for their opinions. We work with partners all around the world who want to know your opinions, and they know how much they’re worth!

We offer rewards for online surveys across all sorts of different subjects and sectors, which gives you the chance to influence big decision-makers in many areas of our daily lives.

You can earn gifts and rewards for fashion, entertainment and retail brands and you can even be paid for online surveys via our PayPal points for cash scheme or our Virtual VISA Prepaid Card.

Our online community at Opinion Outpost means that you can earn rewards for online survey from the comfort of your own home, and no two surveys we will give you are the same. We pay out the equivalent of $390,000 a month to our community through commissioning over three million surveys every month. With a diverse range of topics to complete online surveys on, you’ll never be bored, and you’ll never be short of rewards!

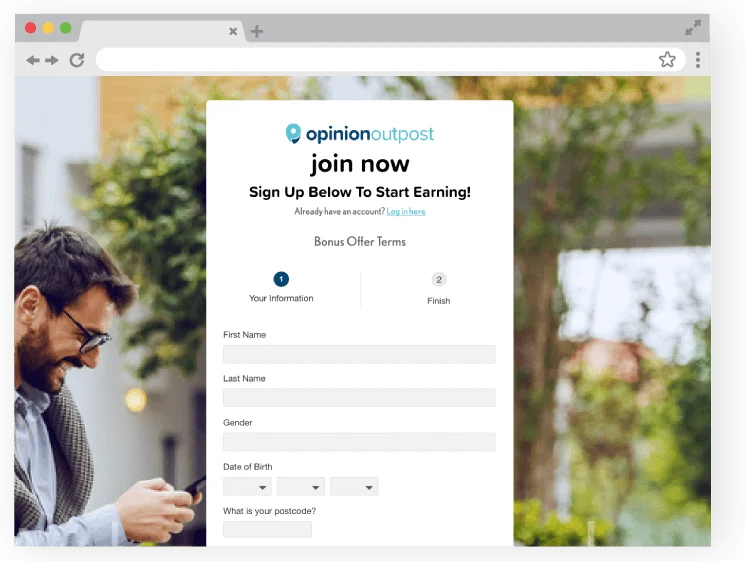

If you want to earn rewards and get paid for surveys online, then why not sign up to Opinion Outpost today!

opinion outpost most commonly asked questions

-

How do Opinion Outpost paid surveys work?

Once you've set up your account, you’ll receive an email welcoming you to Opinion Outpost. From then on, we'll send you regular emails inviting you to take surveys. (These emails will contain all the information you need to take part.)

Earn points every time you complete a survey, and after you have enough points in your balance, you can redeem them for the rewards of your choice.

-

Why do you conduct surveys?

Surveys are conducted because businesses, governments, public bodies, and similar organisations are interested in the views and attitudes of the people who use their products and services. The more they know about what customers and citizens think, the easier it is for them to improve and adapt what they supply.

-

What type of paid online surveys can I take?

We have various surveys available, including:

• Product tests (review prototypes before they hit the shelf)

• Advert reviews (give feedback on ads before they launch)

• Diary studies (keep track of and share your lifestyle habits)

• Focus groups (take part in group discussions on a variety of topics)

• Location-based services (participate in targeted surveys based on your location)

• Ad survey studies (share your thoughts on ads you see on Google) -

What survey rewards can I earn?

Every time you complete a survey, you'll earn rewards points.

You can see the reward offered for each survey in your email or on the 'Surveys' tab. Once you begin, you'll be asked a series of short questions to confirm your identity and to check if you are a match for the survey. Simply answer each question in full to progress and complete the study.

Your reward will be automatically credited to your account when you finish the survey. Certain rewards (such as for diary studies and focus groups) may take up to 6 weeks to arrive.

After you have enough points in your balance, you can redeem them for the rewards of your choice. Visit the Rewards section to check out the rewards we have available!

Please visit our Help page for a complete overview of our FAQ questions.